Texas Tax For Digital Goods | Black Anchor Design

Bobby Robinson • July 23, 2019

Sales Tax for Digital Products in Texas.

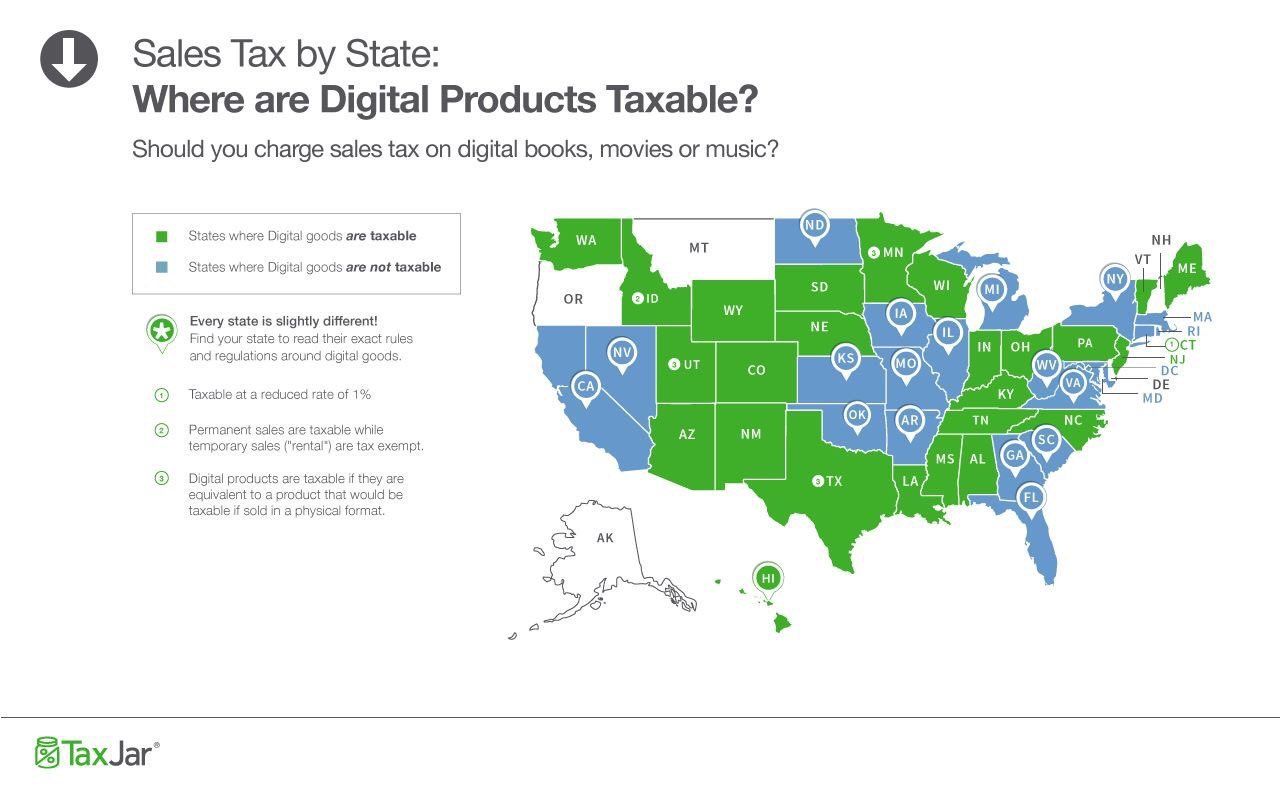

There is no uniform sales tax in the U.S. It is up to each state whether or not it wants to charge sales tax and how much. Any sales your business makes in Texas, you need to look at sales tax on a state level.

The sales tax laws have been updated to include digital goods and services. It's intrepid differently across the various U.S. states, and the application of these laws has been troublesome for most state and local governments.

Quick Stats:

- Twenty-seven states tax digital products.

- Twenty-three states do not tax digital products.

- Five states do not have a retail sales tax at all; these include Alaska, Delaware, Montana, New Hampshire, and Oregon.

- For the states that tax digital products, the tax rate varies from 1% to 7%, depending upon the individual state and the type of digital good.

- Please note that in the U.S., you are only required to collect sales tax in states where you have "sales tax nexus."

It will occur when your business has some "physical presence" in a state, for instance, an office, employees, inventory, affiliates, a drop shipping relationship, or selling products at a trade show or other event. If you have nexus in a state, then you have to apply sales tax to buyers in that state.

What Are Digital Products?

So, which items are considered digital products? With all of the recent technological advances, this is not an easy question to answer.

In general, digital products, or digital goods, are defined as intangible (= non-physical) goods that exist in electronic or digital format. They are delivered to the end customer electronically, such as through email or online download.

Examples include digital media, downloadable music, internet radio, internet television and streaming media, webinars and online courses, fonts and graphics, digital subscriptions, online ads, internet coupons, electronic tickets, online casino credits, downloadable software and mobile applications and online games.

From a tax perspective, there are six types of digital goods:

1. Online data processing services.

2. Downloaded software.

3. Downloaded books, such as eBooks and Kindle.

4. Downloaded music, digital audio files such as iTunes and podcasts.

5. Downloaded movies or digital videos, such as Netflix and Amazon Prime.

6. Other downloaded electronic goods.

States using their definition – In addition to the general categories listed above, many U.S. States have their descriptions of digital goods and services. These include Arkansas, Connecticut, Georgia, Illinois, Iowa, Kansas, Louisiana, Maine, Michigan, Minnesota, Mississippi, North Carolina, Ohio, Oklahoma, Texas, and West Virginia.

States not using any definition at all – There are 18 states (Alabama, Arizona, California, Colorado, D.C., Florida, Hawaii, Idaho, Maryland, Massachusetts, Missouri, New Mexico, New York, Pennsylvania, South Carolina, South Dakota, Utah, and Virginia) that do not explicitly define digital goods.

Texas? YES, taxable as long as the item also is taxable if sold in physical format.

Federal and State Legislation

Not the most straightforward system to understand. Many agree! There have been attempts by the U.S. government as well as individual state governments to make this easier for everyone.

In 2011, the U.S. Congress enacted The Digital Goods and Services Tax Fairness Act. This law provided a federal framework for digital taxes but didn't go far enough in providing guidance and direction for the individual states.

More recently, there have been several attempts by federal and state legislators to create a more homogeneous digital tax, but there has been fierce resistance. The system has remained rather complicated.

Conclusion

You now have a solid understanding of the foundations of sales tax laws Texas and across the country. For further information, contact Texas Comptroller, located in 111 E. 17th Street, Austin, Texas, (817) 818-7708.

By Bobby Robinson

•

September 13, 2024

Unlocking Trust and Business with Google Guaranteed: A Guide for Small Business Owners

In today's digital age, building trust with potential customers is essential for the success of any small business. One powerful way to do this is by earning the coveted Google Guaranteed badge. This badge, prominently displayed on your Google My Business profile, signifies to consumers that your business is reliable, trustworthy, and backed by Google.

By Bobby Robinson

•

October 6, 2021

I would like you to learn more about Benbrook Business Exchange. We are a value-focused networking group composed of highly skilled individuals in our respective fields. We focus on helping build community relationships in a progressive and productive business environment. We share ideas and strategies that stimulate networking growth and success.

AHOY, BOOT!

ALL HANDS ON DECK

FAIR WINDS AND FOLLOWING SEAS

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

Business Hours

- Mon - Wed

- -

- Thu - Fri

- -

- Sat - Sun

- Closed

BLACK ANCHOR IS CLOSED

ON ALL FEDERAL HOLIDAYS

business number